#VOX ETF FREE#

PNQI tracks the Nasdaq Internet Index, a free float-adjusted, market cap-weighted reference for US internet stocks. The $700 million Invesco Nasdaq Internet ETF (PNQI US) was also hit.

SOCL tracks the Solactive Social Media Total Return Index and has around $190m in AUM.

#VOX ETF FULL#

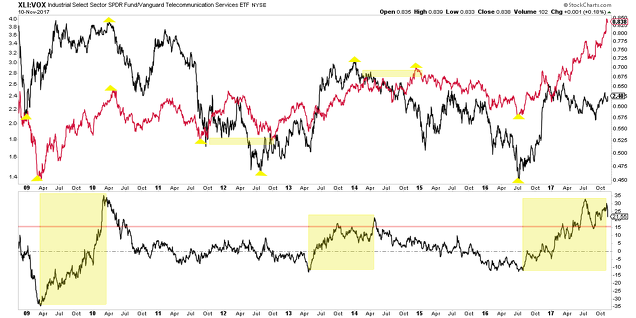

Owing to its 12% holding in Facebook, it too felt the full force of Facebook’s fall, opening down 3.8% from its previous close. Other funds to feel the pinch include the Global X Social Media ETF (SOCL US), which was the first ETF launched to target global firms operating in the social media space. And whilst Facebook reported that total revenue for the quarter rose 42% to $13.2bn, this was below analysts’ estimates of $13.4bn. In a conference call, company executives announced that while the number of active users was up 11% from June 2017, at 2.2 billion, the figure marked the slowest growth in more than two years. The firm has been plagued by data privacy issues recently, including the widely publicised Cambridge Analytica scandal which saw CEO Mark Zuckerberg testify before Congress on Facebook’s data protection policies and sparked a “delete Facebook” movement. It means the fund’s weight in Facebook is a reduced, though still punchy, 12.8%.įacebook’s plunge was triggered by numbers pointing to a slowdown in user growth and rising compliance costs. This transitional benchmark was put in place to minimize the impact to the fund as MSCI (which co-administers GICS) implements the index changes. Investors in the equivalent Vanguard ETF, the Vanguard Communication Services ETF (VOX US), the only other ETF dedicated to the new sector, will be grateful that it is currently tracking a transition benchmark, namely the MSCI US Investable Market Communication Services 25/50 Transition Index. The sector officially launches in September. The SSGA fund only launched last month and tracks the newly minted GICS sector, which is a composition of the existing Telecommunications Services sector along with selected companies from the Information Technology and Consumer Discretionary sectors. SSGA’s recently launched communications services sector ETF has a mighty 21.7% weight in the stock. Those with significant exposure to the company include pure-play internet ETFs, such as the European-domiciled First Trust Dow Jones Internet UCITS ETF and its US equivalent, First Trust Dow Jones Internet Index Fund (FDN), and Communications Services sector ETFs, such as the Communication Services Select Sector SPDR (XLC) from State Street Global Advisors.įirst Trust‘s internet funds have about 9.1% allocated to Facebook. The social media giant saw its market value dive by around $120 billion on Thursday, causing pain for ETFs that hold the stock in significant quantities. Internet and Communication Services sector ETFs have been hard hit by sharp drop in the price of Facebook stock.

0 kommentar(er)

0 kommentar(er)